Depreciation Tax Shield Formula + Calculator

Let’s explore how depreciation can benefit businesses in a simple and engaging way. This a tax reduction technique under which depreciation expenses are subtracted from taxable income.is is a noncash item, but we get a deduction from our taxable income. This will become a major source of cash inflow, which we saved by not giving tax on depreciation. The concept of annual depreciation tax shield is identified as an important factor during financial decision-making by the management in case the business is highly capital-intensive. The business operation will involve the use of assets of larger value resulting in a substantial amount of depreciation being deducted from the taxable income.

Tax Shield Formula

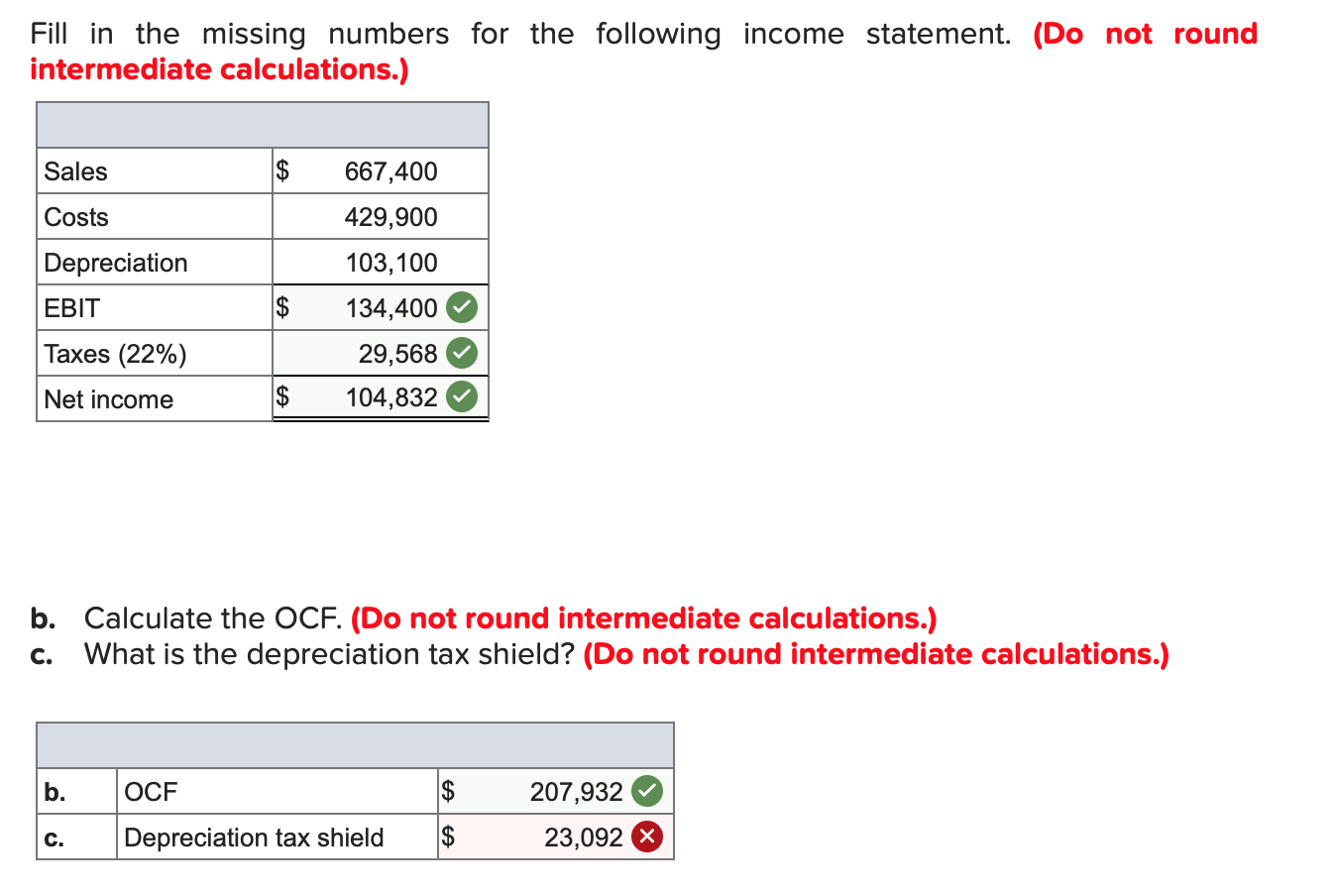

Below we have also laid out the Depreciation Tax Shield calculations using the Sum of Years Digits approach. Below are the Depreciation Tax Shield calculations using the Straight-Line approach. As an alternative to the Straight-Line approach, we can use an ‘Accelerated Depreciation’ method like the Sum of Year’s Digits (‘SYD’). Below, we take a look at an example of how a change in the Depreciation method can have an impact on Cash Flow (and thus Valuation). The dollars saved represent the ‘Tax Shield’ created by Depreciation. As you can see from the above calculation, the Depreciation Tax Savings as the expense increases.

Are There Other Tax Shields?

In the final step, the depreciation expense — typically an estimated amount based on historical spending (i.e. a percentage of Capex) and management guidance — is multiplied by the tax rate. The Depreciation Tax Shield refers to the tax savings caused from recording depreciation expense. Google company has an annual depreciation of $10,000 and the rate of tax is set at 20%, the tax savings for the period is $2000.

- By using a strategy called depreciation, businesses can take advantage of tax benefits and make their money work smarter for them.

- In the final step, the depreciation expense — typically an estimated amount based on historical spending (i.e. a percentage of Capex) and management guidance — is multiplied by the tax rate.

- This happens through claiming allowable deductions like medical expenses, charitable donations, or mortgage interest.

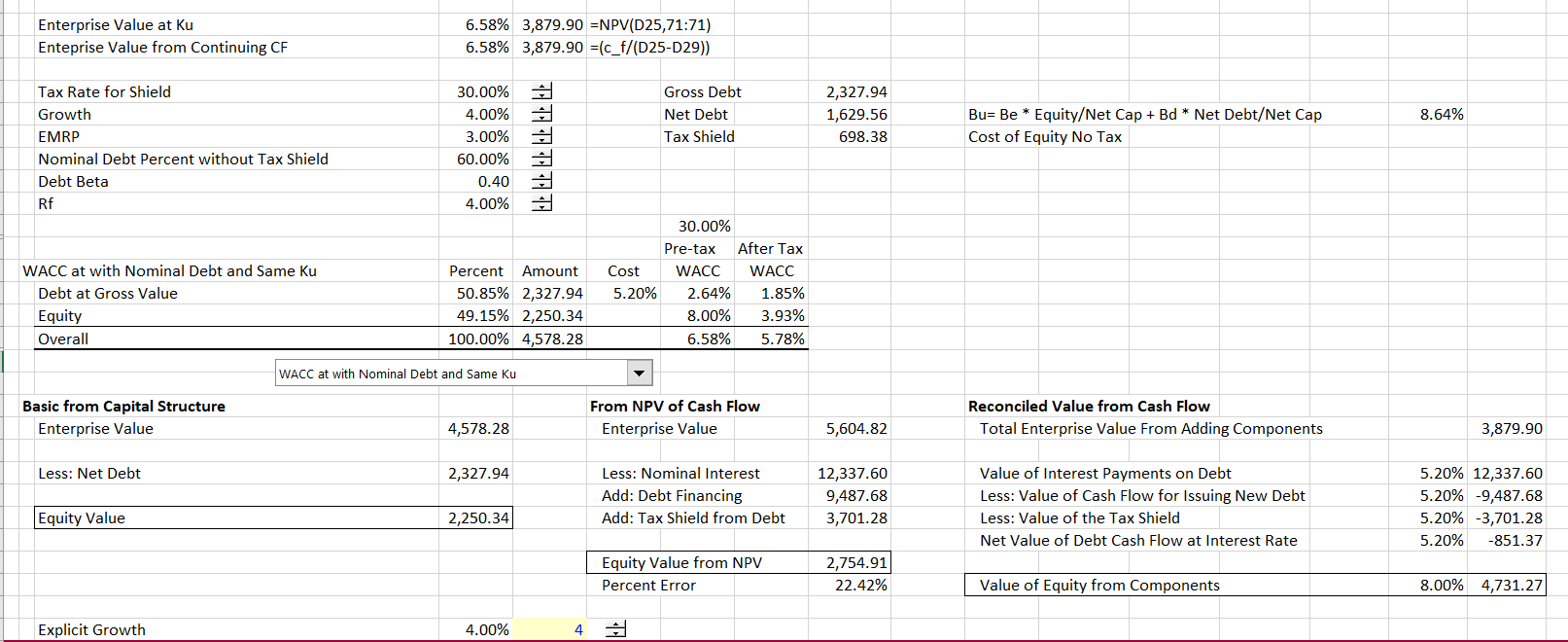

- The value of the interest tax shield is the present value, i.e., PV of all future interest tax shields.

- This will again partly offset the income saved from previous tax reductions.

- The tax shield is a very important aspect of corporate accounting since it is the amount a company can save on income tax payments by using various deductible expenses.

Accretion / Dilution – The Ultimate Guide (

To maximize your depreciation tax shield, it is advisable to consult with a CPA who has experience in our industry. This professional will not only help you to find possible deductible depreciation items but also see if any of these tax savings can be legally accelerated to give you the biggest tax advantage possible. In order to calculate the depreciation tax shield, the first step is to find a company’s depreciation expense. This small business tool is used to find the tax rate by using interest expenses and depreciation expenses. The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction. Or, the concept may be applicable but have less impact if accelerated depreciation is not allowed; in this case, straight-line depreciation is used to calculate the amount of allowable depreciation.

Because depreciation expense is treated as a non-cash add-back, it is added back to net income on the cash flow statement (CFS). The ability to use a home mortgage as a tax shield is a major benefit for many middle-class people whose homes are major components of their net worth. It also provides incentives to those interested in purchasing a home by providing a specific tax benefit to the borrower.

Let us consider an example of a company XYZ Ltd, which is in the business of manufacturing synthetic rubber. As per the recent income statement of XYZ Ltd for the financial year ended on March 31, 2018, the following information is available. But, first, do the calculation of Tax Shield enjoyed by the company.

There are all sorts of opportunities to help reduce the total tax amount you owe when submitting tax filings. For Scenario A, the depreciation expense is set to be zero, whereas the annual depreciation is assumed to be $2 million under Scenario B. So, for instance, if you have $1,000 in mortgage interest and your tax rate is massachusetts tax calculator 2022-2023: estimate your taxes 24%, your tax shield will be $240. The taxes saved due to the Interest Expense deductions are the Interest Tax Shield. Beyond Depreciation Expense, any tax-deductible expense creates a tax shield. As you can see above, taxes are $20 without Depreciation vs. $16 with a Depreciation deduction, for a total cash savings of $4.

The extent of tax shield varies from nation to nation, and their benefits also vary based on the overall tax rate. Interest expenses are, as opposed to dividends and capital gains, tax-deductible. These are the tax benefits derived from the creative structuring of a financial arrangement. The tax shield on interest is positive when earnings before interest and taxes, i.e., EBIT, exceed the interest payment.