Book Value Per Common Share BVPS: Definition and Calculation

The book value per share is calculated using historical costs, but the market value per share is a forward-looking metric that takes into account a company's earning power in the future. With increases in a company's estimated profitability, expected growth, and safety of its business, the market value per share grows higher. Significant differences between the book value per share and the market value per share arise due to the ways in which accounting principles classify certain transactions.

Is a negative P/B ratio good?

Many share market apps offer various tools for stock market investment nowadays which may help you find out what is good PB ratio for a company.. Investors should do extensive study and consider a variety of aspects before making a selection, just like they should with any other investment. By repurchasing 1,000,000 common shares from the company’s shareholders, the BVPS increased from $3.00 to $4.50. Investors can calculate it easily if they have the balance sheet of a company of interest. Investors can compare BVPS to a stock's market price to get an idea of whether that stock is overvalued or undervalued. The Book Value Per Share (BVPS) is the per-share value of equity on an accrual accounting basis that belongs to the common shareholders of a company.

How to Increase Book Value Per Share

It excludes value of intangible assets from book value of shareholders' equity used in the normal book value per share calculation. A P/B ratio of 1.0 indicates that the market price of a share of stock is exactly equal to its book value. For value investors, this may signal a good buy since the market price generally carries some premium over book value. There is a difference between outstanding and issued shares, but some companies might refer to outstanding common shares as issued shares in their reports. The next assumption states that the weighted average of common shares outstanding is 1.4bn. For companies seeking to increase their book value of equity per share (BVPS), profitable reinvestments can lead to more cash.

Why is BVPS important for value investors?

Mathematically, it is the sum of all the tangible assets, i.e., equipment and property owned by the company, cash holdings, inventory on hand minus all liabilities. The price-to-book (P/B) ratio considers how a stock is priced relative to the book value of its assets. If the P/B is under 1.0, then the market is thought to be underpricing the stock since the accounting value of its assets, if sold, would be greater than the market price of the shares. Additionally, P/B ratios can be less useful for service and information technology companies with little tangible assets on their balance sheets. Finally, the book value can become negative because of a long series of negative earnings, making the P/B ratio useless for relative valuation. Overvalued growth stocks frequently show a combination of low ROE and high P/B ratios.

For example, if a company has a total asset balance of $40mm and liabilities of $25mm, then the book value of equity (BVE) is $15mm. Therefore, the amount of cash remaining once all outstanding liabilities are paid off is captured by the book value of equity. Therefore, the book value per share (BVPS) is a company’s net asset value expressed on a per-share basis. In today’s blog, we deep dive into what is book value of a share, what it indicates, and its role for investors. A high P/B ratio suggests a stock could be overvalued, while a lower P/B ratio could mean the stock is undervalued.

Should you worry about book value per share as an investor?

On the other hand, a declining book value per share could indicate that the stock’s price may decline, and some investors might consider that a signal to sell the stock. If a company has a book value per share that’s higher than its market value per share, it’s an undervalued stock. Undervalued stock that is trading well below its book value can be an attractive option for some investors. In closing, it’s easy to see why the book value per share is such an important metric. It’s a simple way to compare the value of a company’s net assets to the number of shares that are outstanding. But be sure to remember that the book value per share is not the only metric that you should consider when making an investment decision.

The tangible book value number is equal to the company's total book value less than the value of any intangible assets. Thus, the ratio isn't forward-looking and doesn't predict or indicate future cash flows. Book value per share (BVPS) is a measure of value of a company's common share based on book value of the shareholders' equity of the company.

If XYZ uses $300,000 of its earnings to reduce liabilities, common equity also increases. ConclusionWhen investors need to assess a company's valuation, the price-to-book, or P/B, ratio is a helpful financial tool. It is important to analyse other financial indicators and market developments rather than using them individually.

Another way to increase BVPS is for a company to repurchase common stock from shareholders. Assume XYZ repurchases 200,000 shares of stock, and 800,000 shares remain outstanding. The book value per share of an undervalued stock is higher than its current market price, so book value per share can help investors appraise a stock price.

- It is the amount that shareholders would receive if the company dissolves, realizes cash equal to the book value of its assets and pays liabilities at their book value.

- Book value per share relates to shareholders’ equity divided by the number of common shares.

- Investors can use the PB ratio to evaluate if a stock is overpriced or undervalued to its book value.

- The book value per share would still be $1 even though the company’s assets have increased in value.

- But be sure to remember that the book value per share is not the only metric that you should consider when making an investment decision.

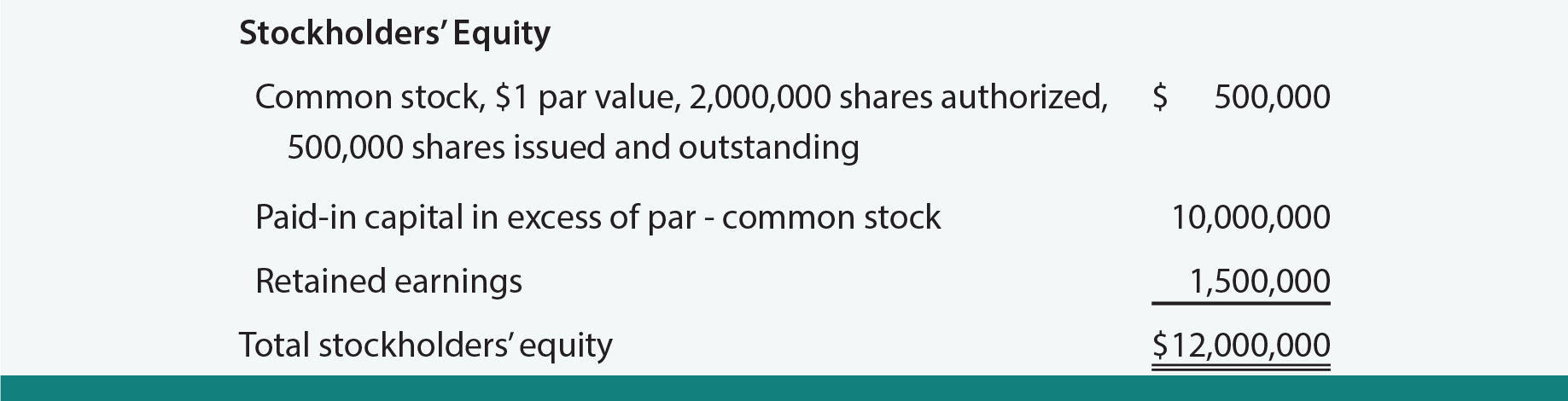

The book value of a company is based on the amount of money that shareholders would get if liabilities were paid off and assets were liquidated. The market value of a company is based on the current stock market price and how many shares are outstanding. Let’s say that Company A has $12 million in stockholders’ equity, $2 million of preferred stock, and export to xero an average of 2,500,000 shares outstanding. You can use the book value per share formula to help calculate the book value per share of the company. Assume that XYZ Manufacturing has a common equity balance of $10 million and 1 million shares of common stock are outstanding. This means that the BVPS is ($10 million / 1 million shares), or $10 per share.